CEO Luc Mory says Naf Naf is planning to open 30 new stores in France this year

Nicola Mira

The mid-range womenswear segment in France is going through a turbulent phase, with names like Camaïeu, Kookaï and PimkieNaf Nafbought in 2020 by its Franco-Turkish supplier SY International

Naf Naf, founded in Paris’ Sentier district 50 years ago, is also hoping to broaden its international footprint, and to gradually shift towards a more upmarket positioning in order to secure future success, as told to FashionNetwork.com

FashionNetwork.com: How did the past year go for Naf Naf?

Luc Mory: 2022 was a very tough year. We expected a revenue of €175 million, and eventually reached €170 million. After the lockdown restrictions that disrupted 2021, last year was first affected by the impact of the invasion of Ukraine and then by inflation. For us, Black Friday week was the most successful of the year, a sign that consumers were waiting for promotions.

Last year, we were still busy on several major transformation projects. We now have the advantage of being a manufacturer-retailer, but connecting factories to stores isn’t quite so easy. Despite our anchoring in the Euro-Mediterranean region (75% of our products come from Turkey, Tunisia and Morocco), garment-making and raw material costs have risen sharply and competition has been fierce, with many labels taking renewed interest in the region. We had to pass on a retail price increase of about 10%.

We have also been busy working on our stores’ profitability, negotiating extensively on rents, as we needed rental costs to be consistent with the revenue generated by each store.

FNW: Have these negotiations been effective?

L.M: Some lessors are cooperating, but it’s not a generalised situation. If disagreements persist, some stores have to close, and will close. To preserve our retail network of 200 addresses in France, we’re actually opting to relocate, and to go ahead with new openings: after inaugurating four to five stores in 2022, we want to accelerate, and we aim to open 30 stores in 2023 (10 in H1 and 20 in H2), chiefly as subsidiaries, to then reach 250 units by the end of 2024.

FNW: Why are you planning such vigorous expansion now? What locations are you targeting?

L.M: There are real opportunities out there, in the wake of the market transformation triggered by Camaïeu’s bankruptcy. Cities are emptying, vacancy rates are rising, so it’s easier to negotiate good rent terms. But we remain selective about locations. The idea is to target small and medium-sized cities, like Pontarlier and Vienne, where Naf Naf will be opening soon, and slightly smaller premises (approximately 120 square metres), where we can have rent-to-revenue ratios below 10%.

FNW: Where are you in e-commerce terms?

L.M: Online revenue accounts for 15% to 20% of our total sales across all channels. It will not exceed 25%-30% in future, via profitable initiatives only. Our store network will remain dominant. We have confidence in physical retail and our customers love to spend time in-store.

However, digital tools can help develop in-store services, such as e-booking. In 2022, we completely overhauled our payments software and hardware, they dated back to the Vivarte

FNW: Do you also see opportunities for expanding internationally?

L.M: Benelux and Spain [where Naf Naf reopened a monobrand store in 2022] are very dynamic markets for our label. In Italy, we took direct control of our retail distribution and set up a subsidiary. Since December 2022, 26 concessions have been active in Coin

Outside France, Naf Naf products sell at higher prices than on our domestic market. When the label is positioned slightly more upmarket, we observe that it performs better.

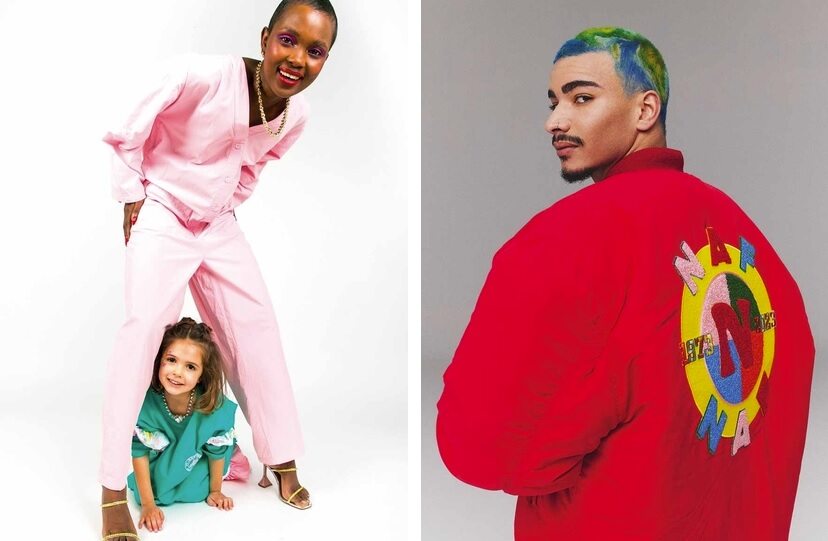

Laetitia Mendes: Our ‘Héritage’ collection, which was launched a few days ago to celebrate Naf Naf’s 50th anniversary, is proof of this. It consists of more high-end archive items, available in limited quantities and in a more streetwear style, which enables us to capture a millennial clientèle, in addition to our usual target of 35- to 45-year-olds. Younger consumers will be looking for our vintage looks on Vinted

FNW: On the product side, how is Naf Naf’s style evolving?

L. Mory: We did some in-depth work on the label’s brand platform with [Parisian trend agency] Peclers, looking at its history, its codes, etc. The new style book is translated into the summer 2023 collection, with more recognisable looks that replicate the label’s original DNA, targeting a younger, more easy-going clientèle.

L .Mendes: Naf Naf has always had fun with design codes, and likes to encourage composite looks. The label is also very keen on being close to its customers. A ‘Naf Tour’ will soon be heading for La Rochelle, Strasbourg and maybe Brussels, with an ad-hoc truck.

FNW: Will you be raising prices?

L. Mory: We’re planning to, but it will be done gradually, going hand in hand with the need to premiumise. On some categories, such as dresses, Naf Naf is compared to more high-end labels, while on other items, like sweaters, consumers cite chains like ZaraPromod

FNW: Many labels are advertising their CSR strategies. What are your plans in this respect?

L. Mory: It’s a major undertaking. We hired someone in-house to centralise these topics. Currently, 30% of our products are more sustainable. The advantage of our proximity sourcing is to limit [the impact of] transportation. A carbon emissions assessment for our activities is being done, and we’re working to implement the EU’s anti-waste law. I don’t know whether we’ll advertise these steps we’re taking ourselves, because customers may tend not to believe us. We might instead opt for an external audit and evaluation.

L. Mendes: In terms of social engagement, we are still committed to supporting women. In 2022, we donated €110,000 to several associations active in women’s advocacy and health, and in promoting young designers.

FNW: How do you envisage 2023, in terms of business results?

L. Mory: The start of the year has been a little complicated. In February/early March, we’ve were impacted somewhat, because our winter inventory has been better managed and is therefore less substantial at the end of the season, while the weather has remained cold. We’re missing products suitable for a cold spring. But we preferred to focus on summer, beginning in April, then continuing in May and June. We’ll have many more novelties then, and we’ll be able to sell in greater volumes. This strategy is costing us a little at the moment, but will pay dividends afterwards.

Our business forecast is not very ambitious, it’s a question of remaining stable in 2023, on par with 2022. The new stores we’re going to open, in France and abroad, are expected to generate €15 million in additional revenue, enabling us to top the €185 million mark.